85% of Americans

took steps to prevent identity theft, such as

shredding documents, checking

their credit reports and changing

their passwords.

85% of Americans

took steps to prevent identity theft, such as

shredding documents, checking

their credit reports and changing

their passwords.

BEWARE OF ATM SKIMMING

If you use an ATM or other card reader, you may become

a victim of identity theft and not realize it until you look at

your account statement. Thieves have been using counterfeit

card readers in tandem with hidden cameras to steal the

information on ATM cards for several years. Once you slide

your card into the reader and punch in your PIN, the thief

has enough information to make another card. Incidents

were up 546% in 2015, with more than 60% of incidents

occurring at non-bank ATMs. While more financial institutions are incorporating EMV chips into their debit and ATM cards,

which make it more diffcult to counterfeit a card, not all of

them have converted yet. Reduce your risk by avoiding

non-bank ATMs and monitoring your accounts for

unauthorized activity.

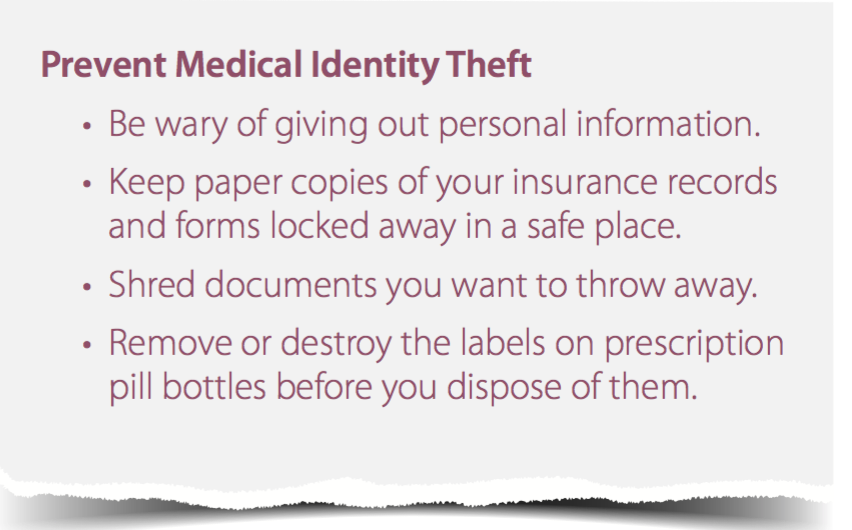

MEDICAL IDENTITY THEFT IS ON THE RISE

More than two million Americans are victims of medical identity theft each year. This type of theft costs the average victim $22,346.3 Thieves steal a person’s name and social security number or Medicare number to receive medical care, drugs or to submit false Medicare claims. Unfortunately, a victim may not realize it’s happened until they get a bill for a medical service they didn’t receive or collection notices for bills they know nothing about.